Researchers Name: Syed Saad Ali Pasha

Affiliation: The Islamic Chamber of Commerce, Industry and Agriculture

Name of the Symposium: AlBaraka Symposium: The Sustainability Authenticity

in Islamic Economy

Session Name: THE NON-PROFIT SECTOR AND ITS ROLE TO ACHIEVE

SUSTAINABILITY

1 Short Biography:

Syed Saad Ali Pasha is an experienced development professional from Pakistan. He is working

as a Business Development Manager at the Islamic Chamber of Commerce, Industry and Agriculture working on projects related to private sector development, poverty alleviation, building climate resilience and digital transformation. Saad previously worked as an Economic Empowerment consultant with United Nations Development Program in Pakistan. Saad is an Erasmus scholar having completed his masters from the universities of Glasgow, Barcelona and Gottingen. Saad also co-authored the book “Global Issues, Local Alternatives” funded by the AKB foundation in Germany.”

Acknowledgements

This work would not have been possible without the support of His Excellency

Sheikh Yousef Hasan Khalawi, Secretary General AlBaraka Symposium and the

Islamic Chamber of Commerce, Industry and Agriculture - ICCIA. I am deeply

indebted to ALBARAKAH Symposium for providing me with the opportunity to

present this pertinent research on one of the most important Islamic Economy

Institutions, The Waqf System, which ICCIA, as an institution believes, will be the

cutting edge towards building climate resilience, reforestation, poverty alleviation

and supporting ICCIA member countries in their journey towards sustainable

development.

Most importantly, it is a moment of honour to present and contribute towards

reviving and revitalizing one of the most important Islamic institutions in the Holy

city of Medina.

Table of Contents

- Executive Summary

- Part I: Waqf and Its historical significance

- Defining Waqf

- The Decline of Waqf; Colonization and Bureaucratization

- Part II: The Islamic Chamber of Commerce, Industry and Agriculture’s “The Green Waqf Initiative”

- The Green Waqf Initiative

- The Green Waqf Initiative Roadmap

- Implementation Strategy for Green Waqf Projects

- Monitoring and Impact Measurement

- ICCIA’s efforts to operationalize the Green Waqf Initiative

- Partnership with Mauritania

- Implementation Strategy for Green Waqf Projects

- Monitoring and Impact Measurement

- The Green Waqf; Examples from Contemporary initiatives

- The Green Waqf Initiative

- Part III: ICCIA Challenges to operationalize the Green Waqf Concept

- Challenges in Developing the Green Waqf Initiative

- Recommendations

- State-level recommendations

- Waqf Level recommendations

- Bibliography

Executive Summary

The research paper is divided into three parts; firstly, it briefly discusses the concept

of Waqf, and its impact on the socio-economic and cultural development of Islamic

history. This part closes by exploring the reasons for the downfall of the waqf system

by discussing the impact of the colonization of the Muslim lands and secondly the

impact of institutionalization and bureaucratization which first led to its desolation

and then abandonment.

The second part of the paper in detail discusses the concept of the “Green Waqf”.

This section explores the Green Waqf framework, development road map and

implementation strategy developed by the Islamic Chamber of Commerce, Industry

and Agriculture – ICCIA to operationalize green projects under the Green Waqf

Initiative. The implementation strategy also highlights the key building blocks of the

Green Waqf framework, such as innovative financing, redirecting of social finance

for authentic development and the utilization of technology to operationalize the

project which will bring help to bring the concept to actualization.

This section also looks at ICCIA’s initiatives and progress made in developing the

Green Waqf concept and preparation for the development of green projects under

the initiative. Lastly, this part also looks at different case studies around the Muslim

world which can be an inspiration for the implementation of the Green Waqf.

The last part of the paper concludes with challenges ICCIA has faced in working

towards the Green Waqf Initiative and recommends two sets of recommendations

directed towards state institutions and individual waqfs which could not only

revitalize existing Awqaf but also help develop new innovative Awqaf abreast of

contemporary social and development issues.

Part I: Waqf and Its historical significance

Defining Waqf

The word waqf means “restraining” or “stopping” in Arabic. In Islamic Law, waqf

is defined as a voluntary, permanent, irrevocable dedication of one’s portion of

wealth to Allah. Waqf is recognized by Shariah as a voluntary charitable act that can

be a source of funding for socio-economic development. The institution of waqf

while being an instrument of Islamic Shariah is not restricted to benefit or for the

use of Muslim communities and religious activities but encompasses a much broader

scope of activities to improve, strengthen and promote inclusive socio-economic

development (Allah Pitchay et al., 2018).

Waqf is an Islamic institution with a rich history of supporting the socio-economic

development of the disenfranchised populations in Muslim countries, historically the

Waqf institution has operated in diverse sectors such as education, medicine,

agriculture, water management and upkeep and development of infrastructural

projects and public works (Abubakar, 2019). The Waqf institution has also played a

fundamental role in influencing, shaping and developing urban spaces and structures

which is highlighted by its cultural imprint on historical major Islamic cities such as

Mecca, Medina, Baghdad, Ispahan, Istanbul and Cairo where public works and

management were developed and maintained through the institution of waqf

(Pirbabaei, 2008).

In addition to the more traditional land waqf the concept of cash waqf has also been

employed to serve the purpose of socio-economic development, the fundamental

difference between cash waqf and land waqf is the perpetual nature of land waqf in

comparison to cash waqf. The practice of cash waqf during the Ottoman times was

employed to reduce the burden on the state capital. The cash waqifs have historically

treated this instrument as an act of charity where they don’t expect anything in return.

To make the cash waqf more sustainable the cash and land waqf can be structured

together to support local communities and make interventions more impactful

(Azganin, Kassim and Sa’ad, 2021).

Cultural relevance of Waqf and its Historical role in Islamic Socio-Economic Development

The institution of waqf is one of the most important aspects of Islamic civilization

and history. According to Saadallah “Waqf is one of the most important aspects of

Islamic civilization; it is a foundation that expresses the will of the Muslim and deep

sense of solidarity with the Muslim community…" (Baqutayan et al., 2018). This is

supported by Cajee who reports that the waqf institution was a “powerful community

supporting institution, e.g., [through] provision of infrastructure and social, health

and educational programmes.” (Zuki, 2012).

In multi-dimensional models of development, waqf is one of the most significant

activities, embedded with the characteristic of piety, providing kindness and social

justice, and promoting innovation, entrepreneurial dynamism and social

development (Zuki, 2012). Development based on the waqf model has social justice

and equality as the central policy (Almarri and Meewella, 2015).

The cultural and institutional foundations of Waqf started from the Prophet (S.A.W)

time starting with the Masjid of Quba. Other Waqf, especially social waqf were also

established from the advice of the Prophet (S.A.W) by the companions that include

the Waqf created by Umar bin Khattab R.A with land in Khaybar and the well of

Rumah by Uthman bin Affan R.A. Since then, various types of Awqaf have been

established by successive Muslim generations and empires which became an integral

part of Islamic societies (Baqutayan et al., 2018; Aamir Rehman, Afnan Koshak,

and Habib Ahmed, 2021). These Awqaf played a pivotal role in the social welfare

and development of local communities. The perpetual nature of waqf and subsequent

additions to it by generations made Awqaf closely linked with the agriculture sector,

it is estimated that Awqaf land made up 75% of the total arable land of modern-day

Turkey, 1/5th in Egypt, 1/7th of Iran, ½ in Tunisia and 1/3rd in Greece. More recent

records from the 20th century indicate that Palestine had 233 Waqf deeds with 890

properties, the size of waqf in Tunisia in 1944 was 482,292 hectares of land that

could be developed commercially out of which 57,505 hectares was of agricultural

land (Jennifer Celik, 2015; Çelik, 2015; Orbay, 2017; Baqutayan et al., 2018).

The institution of waqf was a fundamental part of the Ottoman Caliphate, they would

develop entire complexes (Kulliye) as awqaf, where a collection of buildings that

included mosques, colleges, hospices, hospitals, public food kitchens, and

caravanserais. It is reported, that Sultan Suliman commissioned the Hanseki Sultan

complex comprising 26 villages, bazaars and hospitals maintained and developed as

Awqafs. It is estimated that over 1/3 of the entire revenue of the Ottoman empire

was generated by Awqafs and until the late 20th century there were over 20,000

Ottoman Awqafs and there were over 107,000 hectares of protected Waqf Forest

(Çelik, 2015; Orbay, 2017).

The Awqaf institution also played a substantial role in providing public services that

contemporary states manage including education, health, public utilities, supporting

research and even animal welfare. In Bosnia & Herzegovina, awqaf were developed

for public services catering to helping the poor, orphans, students, travellers, debtors,

and prisoners, and development of wells, public bathrooms, libraries, bridges and

public kitchens (Omercic, 2017).

A great majority of Islamic historical sites and buildings maintained today are tied

to a waqf arrangement or were historically maintained using awqaf. This led to them

not being greatly altered throughout their long history because of the principles of

waqf development in Shariah (Avrami et al., 2019).

To summarize the cultural and institutional imprint of Waqf led to the development

of Islamic societies for over 1,300 years, especially in fields as varied and diverse as

the following:

- Dissemination of Knowledge, and the building of educational centres;

schools, mosques, libraries and madrasas (Omercic, 2017; Orbay, 2017). - Waqf for scientific development and discovery; Astronomical laboratories,

science laboratories and educational hospitals; to teach medicine, nursing and

pharmacology (Pirbabaei, 2008; Baqutayan et al., 2018). - Waqf for the development of urban centres and spaces for cultural

development and engagement (Pirbabaei, 2008). - Development of entire village and housing complexes supported by Awqaf

(Çelik, 2015)

The Decline of Waqf; Colonization and Bureaucratization

Despite being one of the fundamental Islamic development institutions, the Waqf

system began to collapse in the 19th and 20th centuries because of two reasons;

structural changes and colonization of Muslim land (Baqutayan et al., 2018; Aamir

Rehman, Afnan Koshak, and Habib Ahmed, 2021).

Firstly, structural changes, historically waqf were considered to be at odds with

industrialization which led to its decline. The decline of the waqf system had a

substantial impact on the social structure and cultural values of Muslim societies,

one aspect which is not widely known is that large percentages of waqfs were

commissioned by Muslim women and even maintained by women, after

colonization the right to hold, the land was only given to male heirs, this was

especially the in the case of European and British colonization(Fay, 1997a, 1997b;

Çelik, 2015). The disbanding of the waqf also led to massive urbanization and the

rise of the wage class replacing the trade and thriving cottage industries developed

on waqf lands and properties.

The Colonization of Ottoman lands led to the massive dissolution of Waqf

properties. The colonial powers confiscated waqf land and dissolved the waqf

system. For example, in Algeria, the decree of ‘Debarmont’ in 1830 under French

colonial rule resulted in the seizure of all waqf assets by the state, which took over

the rights and authority to manage and distribute returns to beneficiaries(Baqutayan

et al., 2018; Aamir Rehman, Afnan Koshak, and Habib Ahmed, 2021). The Muslim

lands in the Russian empire also faced confiscation of waqf land after the 1917

revolution as all properties of religious communities were nationalized. Likewise, in

Bosnia and Herzegovina over 11,324 meters of land was appropriated by

Yugoslavia. Furthermore, in Macedonia which became part of Yugoslavia, over 7

million square meters of waqf land came under socialist rule(Omercic, 2017;

Baqutayan et al., 2018).

Secondly, Expropriation and nationalization resulted in the seizure of more than

536,023 m2 of waqf gardens, orchards, meadows, arable land, and other properties

in Bosnia alone, in addition to over 600 mosques (Omercic, 2017; Baqutayan et al.,

2018). Muslim lands faced with the threat of colonization and dwindling revenues

also tried to institutionalize waqf properties which led to the commissioning of

national waqf boards. Following are some of the state-led interventions which led to

the centralization and eventual desolation of the waqf system:

- The Ottoman Caliphate commissioned the “Ministry of Awqaf” to protect the

Waqf, instead over time it started using the revenue and property of the Awqaf

(Orbay, 2017). - Post-colonization, Algerian, Egyptian, Tunisian and Syrian Awqaf were

nationalized and soon went into desolation (Baqutayan et al., 2018; Aamir

Rehman, Afnan Koshak, and Habib Ahmed, 2021). - Awaqf in the Indian subcontinent were nationalized leading to desolation or

low productivity. - Al-Azhar University and Complex after 952 years of being run as a Waqf was

given under the control of the Ministry of Waqf (Rashied Omer, 2011).

Additionally, excessive pressure from the European banking system to change the

waqf system from decentralized and autonomous to central systems. Centralized

Waqf led to the bureaucratization of the Waqf system which led to material

exploitation and corruption(Jennifer Celik, 2015; Conte, 2022).

Part II: The Islamic Chamber of Commerce, Industry and Agriculture’s “The Green Waqf Initiative”

The Green Waqf Initiative

Climate change poses critical development, economic and investment challenges,

with its potential to adversely impact lives, ecosystems, and economies. It is welldocumented that climate change and related shocks adversely affect food security.

Developing countries and, above all, poor people tend to be most at risk as they lack

the resources and capacities to adapt, mitigate and cope. An estimated 821 million

people globally are currently undernourished, 151 million children under five are

stunted, and 613 million women and girls aged 15 to 49 suffer from iron deficiency

(Cheikh Mbow et al., 2019). Muslim countries make up 24.38% of the global

population and are gravely affected by climate change and in turn food insecurity.

According to a report by World Food Programme, 24 OIC member countries faced

acute food crises in 2019 while 9 OIC countries are at severe risk of being affected

by global warming and climate change (Hussain et al., 2016; Tribune, 2022).

The Green Waqf initiative is based on the Islamic concept of Waqf "endowment", a

unique form of a philanthropic act having a positive socio-economic impact which

goes on in perpetuity known as "Sadaqa e Jaariyah" or continuous charity. In the

concept of Waqf, there is an emphasis placed on the perpetuity of the asset, which

results in the accumulation of social wealth (Zuki, 2012; Ali and Kassim, 2020).

Waqf has become an important economic sector having the ability to improve socioeconomic conditions and has the potential to contribute towards authentic

sustainability (Ibrahim et al., 2022).

The Green Waqf initiative engages government and private sector counterparts to

identify non-productive Waqf land for reforestation and agricultural activities. This

unique model uses previously undeveloped or depleted areas to create sustainable

socio-economic opportunities for project beneficiaries and support the restoration

and preservation of the ecosystem. While Waqf is a historical concept deep-rooted

in the Islamic tradition, its impact and proof of concept contributing to global

development goals, especially with the SDG 2030 have been backed by projects of

various development banks. The role of the Islamic Development Bank – IsDB in

this regard is quite substantial which developed the Awqaf Properties Investment

Fund – APIF which has a paid-up capital of over $79 million and a financing line of

$100 million from ISDB. The fund has 55 projects in its portfolio operating in 29

countries with a worth of over $1.1 billion(The Awqaf Properties Investment Fund,

2021)

Waqf can be introduced into reforestation, forest conservation, agro-forestry and

forest regeneration, especially for forest conservation, a forest that becomes a waqf

will stay a forest till perpetuity as that is one of the principles of Waqf development

(The Awqaf Properties Investment Fund, 2021; Irfan Syauqi Beik et al., 2022).

Forest conservation is not a new concept in Muslim societies, during the Ottoman

period, over 107 thousand hectares of forest land were protected as Waqf, more

recently, in 2012 in the Aceh province in Indonesia a waqf forest was established by

the local government, here the forest was developed by using the cash waqf to build

a waqf forest. This sets precedence for structuring cash and land waqf together for

reforestation (Ali and Kassim, 2020).

The primary aim of the Green Waqf Initiative is to contribute towards;

a) Building Climate Resilience of member states

b) Food Security of member states

c) Sustainable Employment through an employment multiplier effect

d) Development of sustainable local communities especially vulnerable

populace, women and youth

To support the aforementioned focus areas of the Green Waqf Initiative, underutilized or deforested land can be revitalized by either reforesting or through

sustainable agriculture supportive of the local ecology. This not only supports and

strengthens the Muslim country's climate ecosystem but can also contribute to food

security. As a focus on engaging local communities, the green waqf initiative

engages and supports local communities in proximity to the Waqf land to

operationalize the project.

The Green Waqf initiative in addition to strengthening the local ecosystem and

protecting against climate change will have an employment multiplier effect, the

mushrooming of allied industries will support the different phases of forestation and

agriculture. Currently, there are over 50 million workers employed in the global

forestry sector and given the global initiative to increase the forest cover to protect

against climate change, the number of green jobs is bound to increase (Rutt, 2009).

The positive impact of reforestation on employment generation in Pakistan was quite

evident under the "10 billion tree Tsunami" initiative taken by the government,

which was able to generate 85,000 direct jobs for reforestation (Pakistan’s Ten

Billion Tree Tsunami, 2021).

The reforestation and agro-forestry based on the principles of the Islamic Waqf

System effectively decommoditifies the land, meaning the land can only be used for

a certain purpose, that is, forestry (Ceman Che Azizi, Asiah Kamal, and Muhammad

Nazul Hoqu, 2018). This will enable the greening and revitalization of the land to be

sustainable while keeping abreast of indigenous communities and their needs. The

green waqf will effectively result in the following:

- Decommodification of the Land

- Localizing Indigenous Sustainability and Greening Initiatives

- Protection against Land encroachment and Deforestation

- Protecting and economically empowering the local communities

What distinguishes the Green Waqf Initiative from the existing reforestation and

agricultural projects is that the Green Waqf asset base or land will remain intact and

will be used by beneficiaries, the local communities and people engaged in work, in

perpetuity and will be funded by the revenues generated by the land itself.

The Green Waqf Initiative Roadmap

The Green Waqf Initiative roadmap aims to operationalize projects that encourage

and prioritize sustained economic growth, reduced inequalities, increased

inclusivity, especially for the disenfranchised part of the communities and equitable

growth to achieve economic and environmental resilience. The Green Waqf

Initiative’s roadmap focuses on developing a fertile ground which can provide an

alternative to conventional investment opportunities to promote financial

sustainability while simultaneously achieving social and economic benefits. Projects

under these guidelines can include SMART agriculture, agroforestry and

reforestation which is the priority of the Green Waqf Initiative.

To initiate the Green Waqf Initiative, the Islamic Chamber of Commerce, Industry

and Agriculture has proposed the following roadmap:

To operationalize the Green Waqf Initiative, ICCIA has identified a potential

roadmap of how to initiate the project;

a) Advocacy: ICCIA will highlight the flagship Green Waqf Initiative at various

forums, including at universities and climate-related events and forums to develop

awareness about the potential impact of the Green Waqf Initiative and how it can help develop climate resilience, and sustainability and economically empower local communities.

b) Identification of Potential Partners: ICCIA will identify potential partners in both

the Government and the Private Sector to partner and operationalize the Green Waqf

Initiative. This includes the religious and agriculture ministries, chamber of

commerce, private sector organizations focused on sustainability, academia and

research organizations and media to highlight the project.

c) Feasibility Study: ICCIA will engage in country-specific feasibility studies for the

piolet countries study in detail the local environment of the potential pilot countries

and the viability of initiating the project, the study will also do a systematic risk

analysis of the countries and map relevant stakeholders and risks the project might

face.

d) Manual & Legal Framework Development: To operationalize the project and

make the project replicable in member ICCIA countries, ICCIA will engage a

consultant to develop a detailed process and operational plan for the project, this will

also include identification and mapping, identification and convergence of best

practices into a viable plan for the project. The manuals will also include the design

of the project teams and a relationship analysis and mapping between internal and

external stakeholders. ICCIA will also engage legal experts to develop a legal

framework to establish the Green Waqf Initiative and projects under it in member

countries, here ICCIA through legal experts will do a thorough legal analysis to

ensure the legal sustainability of the Waqf projects and that they benefit local

communities for whom the projects are established for.

e) Agreements with Relevant Stakeholders: To initiate the projects under the Green

Waqf Initiative, ICCIA will sign agreements with relevant stakeholders; the

Government, Implementation partners, and the private sector to operationalize the

projects.

f) Developing a Social Finance Platform: ICCIA will develop crowdfunding/social

financing/crowd planting that will be dedicated to the Green Waqf Initiative’s

projects.

g) Establishing a Waqf Entity: All the prerequisite steps will help ICCIA will

establish independent Waqf entities that will develop, operationalize, and maintain

the Waqf land and projects according to the needs and the legal landscapes of pilot

countries.

h) Official Launch of the Green Waqf Initiative: ICCIA will have an initiation event

to launch the Green Waqf Initiative, a flagship event that will officially launch the

initiative and invite stakeholders from the government, media, private sector,

academia and most importantly, ministries and stakeholders related to religious

affairs to highlight the importance and long-term potential impact of forestation and

especially the unique self-sustaining Green Waqf concept.

i) Opening the Social Financing Call: As the initiative is based on Social Financing,

the project will initiate a funding call and engage the private sector through different

channels to engage in different Green Waqf Projects.

j) Engaging the Private Sector in Strategic Buy-in: ICCIA will engage the private

sector to support the projects under the Green Waqf initiative to ensure sustainability

until the Waqf land becomes self-sustainable.

k) Monitoring and Periodical Evaluation: ICCIA will engage in a periodical

evaluation of the project progress against agreed-upon work plans and the use of

finances to ensure transparency of the initiative.

The stages proposed in the roadmap set out a step-by-step process which can be

replicated in different pilot countries, given the different dynamics and differences

in local socio-political and legal systems and regulations the process might differ

and for that reason a manual and legal framework development is necessary to be a

guiding tool while implementing the projects under the Green Waqf Initiative. Some

processes of the roadmap, including the Social Financing Platform, partnerships with

relevant stakeholders and feasibility studies will be implemented irrespective of the

countries to provide maximum benefits, synergy and measurability of the projects

under the Green Waqf Initiative.

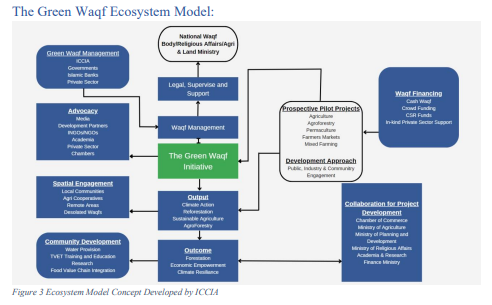

Implementation Strategy for Green Waqf Projects

ICCIA has recognized the importance of engaging multistakeholder partnerships for

the successful implementation of the projects under the Green Waqf Initiative and

believes in thorough research and planning to achieve the critical milestones

identified in the Green Waqf Initiative roadmap. To this end, ICCIA has

conceptualized an implementation strategy which explains the key elements of the

roadmap to operationalize projects under the Green Waqf Initiative.

The steps in the roadmap have been summarized under the following critical stages:

- The Green Waqf Ecosystem Model

- Promoting Innovative Financing Models and Developing Social Financing

Platforms - Developing Waqf Entities (Projects and Initiatives) & Pilot Testing

- Monitoring and Impact Measurement

- Replicating in member countries

- To ensure the sustainability of the projects under the Green Waqf Initiative,

ICCIA believes it is paramount to engage with national waqf institutions, the

ministry of religious affairs and land management authorities in any country as they

will provide the legal and regulatory framework to establish the Green Waqf entities. - ICCIA through its platform and access to the private sector of 57 member

countries will play a board or advisory role to make sure the Waqf entities are

governed according to the waqf deeds and agreements. Additionally, organizations

with a strategic stake in the waqf asset will perform the role of the waqf management

committee. - A substantial advocacy campaign has to be implemented to engage relevant

stakeholders so they engage with ICCIA to help outreach for the Green Waqf

Initiatives and individual projects. - Prospective pilot projects will be developed by engaging with local

stakeholders from the community and after developing feasibility studies and

manuals, this will help in engaging with the right stakeholders and identify projects

which best suit the local community needs and future sustainability requirements.

- To operationalize the pilot projects development needs of local communities

have to be kept in mind, engagement levels have to focus on community levels and focus on participatory development methods for inclusive development and sustainability.

- Projects can utilize various sources of funding, including, crowdfunding,

CSR, and social finance, more of this will be discussed later on in the “Developing

Social finance platform” part. - The projects under the Green Waqf concept have to be at par with

development initiatives and follow global best practices, for that to happen it is

vitally important to engage relevant stakeholders, especially from the development

and the private sector to share knowledge and synergize socio-economic

development initiatives while keeping abreast environmental impact of the

initiatives. - As the Green Waqf concept is centred on the development needs of the

community and aims to localize development, inclusive development has to be

prioritized. This means the benefit of the projects and impact should translate into

social development and access to public goods and infrastructure to support

inclusive development.

Enabling Innovative Financing Models and Developing Social Financing Platforms

The covid-19 pandemic and the subsequent global economic downturn widened the

development financing gap from $2.5 trillion to $4.2 trillion. To bridge this gap

unlocking social financing can be utilized to achieve true sustainability (Catherine

Bremer, 2020; SDG Knowledge Hub, 2022).

To bridge the financing gap, redirecting social financing through crowdfunding as

the financing mechanism for the Green Waqf Initiative has been conceptualized. The

green waqf initiative can structure the two waqf modalities; land waqf and cash waqf

together to unlock financing for agroforestry, building climate resilience and

working towards food security.

Philanthropic contribution to Green Waqf aligns with the concept of the Green Waqf

Initiative. According to studies by 2016, the global crowdfunding industry was

valued at over $144 billion, with donation-based crowdfunding amounting to $0.56

billion. While the quantum of crowdfunding is growing it still captures a minuscule

portion of the global estimated charity of $400 billion (Michele Scataglini, Marc and

J. Ventresca, 2019).

To achieve authentic sustainability, collective action and effort are essential.

Crowdfunding supports collective action and also has the potential to stimulate

innovation and create opportunities for employment in the developing world.

Crowdsourcing has allowed developing economies to have the potential to drive

growth by employing crowdfunding to leapfrog the traditional capital market

structures and financial regulatory regimes of the developed world (World Bank,

2013)

Crowdfunding has been used to fund many green projects around the world. One

such success story is that of the Bob Brown Foundation. The organization targets

environmental issues and challenges and raises funds through crowdfunding to

achieve its targets. In 2020, the organization raised funds for its campaign called

'Save Australia's Native Forests,' through this, they were able to raise $130,354 from

1426 supporters. The Bob Brown Fund plans to use these funds to protect

endangered species, research activities, advertisement campaigns and reforestation.

So far, the fund has hosted 10 successful crowdfunding campaigns (Australia’s

Native Forests, 2021)

Another success story of crowdfunding is Reforest'Action, a French B Corp-certified

company that works to preserve, restore and create forests. Reforest'Action has

developed a model called crowd planting, the model supports participatory planting

and allows people to take concrete action for protecting the planet. Using the crowd

planting model has allowed Reforest'Action to plant 23 million trees in 42 countries,

with the commitment of 3,000 companies and 400,000 citizens(Reforest’ Action,

2020).

The above success stories represent the potential of crowdfunding. The projects

under the Green Waqf Initiative can leverage the potential of crowdfunding for

sustainable reforestation, agroforestry and building climate resilience. Additionally,

the crowdfunding model can access funding from around the world and generate

funds to ensure the sustainability of the projects under the Green Waqf Initiative.

The use of crowdfunding as a tool for reforestation, agro-forestry and agricultural

activities is gaining ground around the world and has received much interest from

researchers. Here, the focus is on donation-based crowdfunding instead of

investment crowdfunding. This is to redirect Islamic social financing or cash waqf

towards sustainable development practices, especially towards building climate

resilience. As a proof of concept for the redirection of social financing for

sustainable development, a philanthropic crowdfunding platform LaunchGood

raised $385 million since its establishment in 2013 (Azganin, Kassim and Sa’ad,

2021).

Green Waqf Initiatives “Social Financing Platform”

ICCIA will develop a crowdfunding/social financing/crowd planting that will be

dedicated to the Green Waqf Initiative’s projects. The platform will give the ability

to people from around the world to choose campaigns, sites and projects to which

they can relate and fund them using their Islamic social finance. This platform by

ICCIA will ensure the sustainability of Islamic social financing and help people even

track their contribution by looking at the results of sustainable agricultural,

agroforestry and climate resilience projects. The platform simultaneously will be

able to showcase multiple projects and sites around the 57 Muslim member countries

which will allow redirecting social financing towards the most needy and vulnerable

countries and communities.

Developing Waqf Entities (Projects and Initiatives) & Pilot Testing

This part will focus on two important steps in operationalizing the Green Waqf

concept; Developing Waqf entities and pilot projects.

The development of waqf entities will be guided by the manual and legal framework

studies, this will help understand the local dynamics of each country and develop the

waqf entities accordingly. ICCIA has currently partnered with Ziaudin Law

university in Pakistan to develop the legal framework to operationalize projects

under the Green Waqf Initiative and how to register Green Waqf in Pakistan as a

pilot country. Secondly, to develop waqf projects, all the prerequisite processes have

to be followed, including feasibility, manual development and ecosystem mapping

and partnership development. The studies should focus on two vital things, market

analysis to make gauge the demand and supply of the produce and secondly, the

technical aspect of the study to understand the resource requirements to

operationalize the projects. The studies should also focus on the potential

environmental outcomes and identify key measurement indicators to measure

project achievements

Monitoring and Impact Measurement

Project monitoring and impact measurement will be vital to showcase the authentic

sustainability impact of the Green Waqf Initiative. The manual and operational plan

will develop key metrics and performance indicators for the Green Waqf Initiative

projects to systematically assess the sustainability impact of the concept. Monitoring

and Impact measurement can a collaborative effort between waqf management

entities and third-party evaluators.

Replicating in member countries

The replication stage will be focused on mainstreaming the Green Waqf Initiative in

other ICCIA member countries, for that to happen certain vital steps have to be taken

into consideration in addition to certain steps, which will be replicated from the

Green Waqf implementation roadmap.

- Adapting the legal framework to the localized legal, social and economic

requirements; consultative sessions can be planned with relevant

stakeholders to identify if the country needs a completely new feasibility and

manual study or if existing practices can be implemented with minor changes. - Advocating for policy change; This entails engaging local relevant

stakeholders, especially from the government to enable policies that are

conducive to the development of the Green Waqf concept and its subsequent

projects. This can also include tax breaks, especially for the private sector to

engage with projects under the Green Waqf Initiative. - Advocacy Campaign; The promotion of the Green Waqf concept by

engaging state media and relevant channels is vital to raise and redirect social

financing for the projects. - Embedding Innovation; As the Green Waqf Initiative is “reimagining” the

institution of waqf for green projects it is critical for innovation and practices

and the use of technology for land management, project development and

impact measurement. - Linking Green Waqf projects with the Startup Ecosystem; For the Green

Waqf projects to play a substantial role in sustainability, it is critical to link

the projects with the startup ecosystem. This can be achieved by engaging

academia and research think tanks to increase youth uptake of the concept in

pilot countries to develop innovative projects focused on technologies of the

future to develop localized solutions to development needs.

ICCIA’s efforts to operationalize the Green Waqf Initiative

As its flagship initiative, the Islamic Chamber of Commerce, Industry and

Agriculture has been in the process of developing the ecosystem, partnering with

key strategic stakeholders and advocating to first promote and then operationalize

the project in member countries.

Partnership with Mauritania:

ICCIA has recently signed MoUs with member Mauritania, a member country to

mutually develop the Green Waqf Initiative. The scope of the partnership includes;

i. Promote the Green Waqf Initiative by collaborating in the implementation of

training and awareness programmes in this area.

ii. Collaborate on the implementation of the Green Waqf Initiative in the Islamic

Republic of Mauritania with relevant government and non-governmental

entities.

iii. Jointly mobilize, youth and relevant parties to participate in forums, workshops

and organized events.

iv. Support a culture of creating sustainable local communities and establishing a

self-sustaining business model or Waqf company where income generated by

reforesting and agriculture would be reinvested in the operations of the

project/Waqf land.

v. Support the presence of Mauritian entrepreneurs in relevant

national/international events.

Key Partners:

- The partnership agreement includes the Mauritanian chamber of commerce to

mobilize the private sector to raise financial support for the project. - The partnership also includes strategic buy-in from the Minister of Social

Work, Childhood and Family to mobilize resources and manpower to

operationalize the projects under the Green Waqf Initiative.

The partnership has the patronage of the Presidency of Mauritania highlighting the

strategic importance of the Green Waqf concept for ICCIA and Mauritania.

Chad Economic Recovery Plan:

One of ICCIA’s flagship development plans for its member country, the CHAD

economic recovery plan also includes the Green Waqf Initiative, here ICCIA is also

engaging relevant stakeholders through the member chamber of commerce to

advocate for the concept and develop partnerships to operationalize the project.

Partnership for Legal and Regulatory Framework Development

ICCIA recently signed a memorandum of understanding with Ziaudin Law

University in Pakistan to co-develop the regulatory and legal framework to develop

the Green Waqf Initiate and projects, here Ziaudin’s team of legal researchers will

support ICCIA in;

- Developing the legal framework for the development and operationalization of

the Green Waqf Initiative for ICCIA member countries. - Support in developing a legal profile of Waqf entities in Pakistan, identifying all

the relevant factors in registering, operationalizing and maintaining waqf entities. - Ziaudin University will utilize its platform to engage relevant stakeholders to

initiate discussions around the utilization of Waqf as an instrument of

sustainability, reforestation and land conservation in Pakistan.

Onboarding of Experts

To highlight the importance of the Green Waqf Initiative and ICCIA’s strategic buyin of the concept, ICCIA has hired a team of experts to help develop the projects

under the Green Waqf Initiative.

ICCIA has brought on board Agricultural and Technology specialists that will guide

the project and social financing platform development of the Green Waqf Initiative,

this will support taking the initiative from a concept to actualization by developing

sustainable technology solutions and projects.

Launch of ICCIA “The Green Waqf Initiative” Website

To highlight Green Waqf Initiative, ICCIA has developed and launched the Green

Waqf Website, while the website is still in preliminary stages, it has the following

features

- Environmental profiles of 11 member countries

- Carbon calculator to understand the trees required to offset the carbon

footprint - Blog section to get publications from students, researchers and

environmentalists. - A live global forest cover indicator.

- A section explaining the Green Waqf Initiative

- A section highlighting proximate examples from around the world.

The Green Waqf; Examples from Contemporary initiatives

The idea of the Green Waqf Initiative takes root in the Islamic history and practices

of the companions of the Prophet (S.A.W), a well-known example of Waqf is the

well of Hazrat Uthman Bin Affan (Azganin, Kassim and Sa’ad, 2021). The well is

still a functioning waqf and is used to cultivate palm trees and distribute its fruits to

the less fortunate people, till now more than 15,500 palm trees have been grown

using the water from this well (Abdullah, 2020).

More contemporary examples and models which have operationalized waqf as a tool

for promoting sustainability, promoting climate resilience, reforestation and

agroforestry are:

Sheikh Saleh Al-Rajhi Awqaf Sheikh Saleh bin Abdulaziz Al-Rajhi endowed

farms that spread over 5,466 hectares and have nearly 45 types of date palms,

entering the Guinness Book of World Records in 2011 (Shafinar Ismail, M. Hassan,

and Suharni Rahmat, 2023).

Establishment of a Piped Water System in Shiraz City: Haj Muhammad Namazi

was the founder of Shiraz Water Corporation, which initiated the establishment of a

piped water system to combat diseases in Shiraz City. The Waqf Shiraz City water

complex included 60 water wells and 1,300 kilometres of pipe networks and served

175,000 subscribers in 1990 (Pirbabaei, 2008; Baqutayan et al., 2018). This project

brings benefits to the society of Shiraz City, such as universal access to water for the

municipal population and a decrease in the emergence of diseases, which echo the

spirit of SDG 3 (Health for All) and SDG 6 (Clean Water and Sanitation).

Kuwait Company For Environmental Services: Kuwait has a special agency

tasked with waqf management, namely Kuwait Awqaf Public Foundation (KAPF).

KAPF not only focuses on ordinary waqf management, such as mosques but has also

initiated efforts to support environmental protection. This project aligns with SDG

13 (climate action) and enables continuous efforts to tackle environmental problems

in small states through the provision of a dedicated perpetual fund for the

environment. This is important for a country like Kuwait because despite having

plenty of wealth from oil, the country has difficult environmental situations, such as

a small land area and desert climate (Khalil, Ali and Shaiban, 2019).

The Bogor Waqf Forest Foundation: One of the best contemporary examples of a

Green Waqf type model is the “Bogor Waqf Forest” in Indonesia, The Bogor Waqf

forest is developed by lecturers from Institut Pertanian Bogor in 2018 (Ali and

Kassim, 2021). Till 2021, the Bogor Waqf Forest Foundation collected over $ 30,000

which came from Zakat, Waqf and other forms of Islamic social financing and

contribution (Khalifah Muhamad Ali et al., 2021).

The Bogor Waqf Foerst is based on three thematic areas; Ecological, Economic and

Social-Humanitarian. Under the Ecological area, the Bogar waqf forest foundation's

focus area is raising cash waqf to buy land and convert it into a waqf forest. So far,

over 1000 forestry trees are planted.

For the sustainability and economic viability of the project, stingless bee cultivation

was selected as it helps with natural pollination.

To support the social and humanitarian area, the Bogor Waqf Forest Foundation in

collaboration with the BAZNAS disaster unit, a disaster resilience and training

programme for the local communities(Ali and Kassim, 2021; Khalifah Muhamad

Ali et al., 2021).

Part III: ICCIA Challenges to operationalize the Green Waqf Initiative

Challenges in Developing the Green Waqf Initiative

The Islamic Chamber of Commerce, Industry and Agriculture has faced a plethora

of issues in operationalizing the Green Waqf Initiative, from minimal public

awareness of the concept to unresponsive state institutions. The challenges ICCIA

has faced are discussed in detail below:

Low Public Awareness of the potential of Waqfs: The Waqf system despite being

part of the Islamic economy for over 1,400 years is still not understood, the general

population still considers it to be an act of charity and does not realize the full

potential of the concept. The Waqf system has historically been the backbone of

Islamic civilizations to provide social services and public works for the general

population. As the paper thoroughly discussed the reasons for the abandonment of

the waqf system and also explained the reason that the potential of Awqaf is also not

a central debate even in the modern Islamic academic discourses (Baqutayan et al.,

2018; Aamir Rehman, Afnan Koshak, and Habib Ahmed, 2021; Irfan Syauqi Beik

et al., 2022).

Absence of Proper Database and documentation of Waqf Estates: One of the key issues in developing Waqf forests or Green Waqf is the absence of proper database and documentation of waqf properties. ICCA has reached out to state institutions to identify waqf land that can be used for green projects in member countries to limited benefit. This problem arises because of two reasons, firstly, most Muslim countries have not mapped properties or know where the Awqaf are located, especially the Least Developing Countries where governance structures are still archaic and need digitalization.

Secondly, a majority of Awqaf were developed before the colonization of the

Muslim world, making it hard to trace back the documentation, purpose and intended

benefactors of the Awqaf (Pianciola and Sartori, 2007; Aamir Rehman, Afnan

Koshak, and Habib Ahmed, 2021).

Awqaf property use is limited to religious practices: In the subcontinent, most

Awqaf properties are used to maintain and construct mosques, seminaries, graveyards or shrines vastly undermining the potential use of the land for more development-orientated purposes(Abbasi, 2019; Aamir Rehman, Afnan Koshak, and Habib Ahmed, 2021). The case in Pakistan is quite stark as most waqf properties which are publicly known are either used for mosques, cemeteries or shrines (Abbasi, 2019).

Outdated Legal and Regulatory Framework: Most Muslim countries lack an enabling legal environment and regulatory framework to support the development of Waqf. In some countries and jurisdictions, the Waqf law does not exist or is either inefficient or not updated to science, technology, research and contemporary developments. Even in countries where the waqf law exists, they fall under the Anglo-axon law of “trust” making it difficult to incorporate certain features of Waqf like the perpetuity of the asset (Josh and Mak, 2014; Ceman Che Azizi, Asiah Kamal, and Muhammad Nazul Hoqu, 2018; Aamir Rehman, Afnan Koshak, and Habib Ahmed, 2021).

Archaic Waqf management: In some countries in where waqf law exists, it may be outdated or inefficient. Waqf law has fallen behind other organizational formats such as trust and nonprofit organizational laws, as the former has some of the most rigid clauses that put constraints on its management and development. Waqf laws need to be updated by incorporating some of the contemporary management and governance standards and adding flexible Shariah perspectives (Aamir Rehman, Afnan Koshak,

and Habib Ahmed, 2021).

Underdeveloped Waqf Assets and Low yielding business models: Awqaf in most

countries remain underdeveloped and invested in commercial operations with lowyielding returns. For example, in India, waqf properties yield a return of only 2.7% while the potential annual return for the properties is over 10% (Abhishek Parmar, 2017). Here, innovative businesses have to be conceptualized, where businesses based on research and technologies for the future must be embedded while dealing with Waqf properties to rejuvenate waqf properties and develop case studies for replication. As a focus of this study is the Green Waqf, waqf properties can be used to develop agricultural research centres and agri-innovation labs to develop technologies, both physical and intellectual to fund the development of the Green Waqf and replicate the practice.

Recommendations

To meet the contemporary development needs of the Muslim ummah and work towards authentic sustainability, the institution of waqf has to be revitalized and reimagined as being complementary rather than an impediment to modern economics and development.

The Islamic Chamber of Commerce, Industry and Agriculture believes the Green Waqf Initiative can be cutting-edge in building climate resilience, working towards food security while empowering local communities it decommoditifies the land, meaning land can only be used for a certain purpose. It helps localize indigenous sustainability initiatives because local communities are involved. And most importantly, it protects against land encroachment and deforestation which is a serious development challenge in Muslim countries (Vaghefi, Siwar and Aziz, 2015).

The paper recommends a set of state-level and individual waqf-level recommendations which can potentially propel the institution of waqf into a modern tool to unlock finance for authentic development and work towards building climate resilience, food security and sustainable agriculture.

State-level recommendations

Advocating for Policy and Institutional Coherence: The management of waqf falls under different state institutions in different Muslim countries, in the case of Saudi Arabia four different government organs deal with Awaqf that include the Ministry of Justice, General Authority of Awqaf, Ministry of Human Resources and the Federation of Saudi Chambers. There needs to be a mechanism which coordinates the efforts of all these organizations to synergize the efforts and reduce duplication of work. This was also the recommendation of the UN report highlighting the role of Awaqf in achieving sustainability in Saudi Arabia (Aamir Rehman, Afnan Koshak, and Habib Ahmed, 2021).

Enabling Legal and Regulatory Framework: Most Muslim countries either don’t have waqf laws or have an underdeveloped legal and regulatory framework to support the Waqf sector. There is a need to develop regulatory frameworks and legal guidelines which are at pace with the needs of developing new Awqaf and how they can be integrated into the modern economy. These laws should identify the different

types of Waqf assets, permissible activities and business frameworks to make it easier to develop new Awaqf. Additionally, to match modern corporate governance and transparency, they ensure, among others, Shariah compliance, financial transparency, and operational efficiency of the Awqaf. For the latter, A standardized Waqf accounting and financial reporting system and a monitoring system can be introduced to assess Waqf management performance and operational efficiency. (Aamir Rehman, Afnan Koshak, and Habib Ahmed, 2021)

Develop a Digital Waqf Management System; Identification, Assessment, Monitoring: One of the key issues in most Muslim countries is the availability of data on Awaqf properties and their contribution to key sectors. It is recommended to establish a waqf identification and statistical measurement authority which collects the data on Awqaf and measures their impact on the country’s economy and

respective sectors.

Waqf Level recommendations

Use of Technology and Innovation: In the age of the Fourth Industrial Revolution, the Awaqf must introduce the use of technology in their management, products and services to keep up with parallel social support and development institutions. Given the uneven development patterns of different Muslim countries, building the capacity of Awqaf will be faced with barriers such as lack of infrastructure, digital

access, up-skilling, and reskilling digital skills can inhibit its use (Celine Herweijer et al., 2020). While the infrastructure and digital inclusion might not come under the scope of individual Awqaf, they can still develop platforms like “MyWaqf” established in Malaysia, which has three objectives; to develop a relationship with Islamic Banks to spearhead innovation in waqf development, identify waqf projects

for development and widen waqf collection through banking channels. (‘Our Model’, 2020)

Synergizing with Islamic Finance Sector: Most Awqaf are situated in prime locations and have strategic value but as discussed earlier are not operating efficiently, with the right investments and linkages with the financial sector they can be revived and developed further. Prime examples from Saudi Arabia of the Zamzam towers were funded by Sukuk bonds, similarly, the waqf building in Medina for the research centre was funded by the Awqaf Properties Investment Fund (Shukri, Zamri and Muneeza, 2019).

Additionally, Awqaf can also reduce poverty and inequality by financing small and micro enterprises currently not served by the financial sector. Examples from Saudi Arabia such as Sulaiman Al-Rajhi Foundation for Development Finance, Almajdouie Foundation, and Al-Ohali Foundation, provide microfinance to the poorer sections of the population, thereby contributing to financial inclusion and

economically empowering them(Aamir Rehman, Afnan Koshak, and Habib Ahmed, 2021).

Aligning with Country Development Priorities: A legacy of Muslim countries' colonization is the unavailability of waqf deeds and limited clarity of the intended benefactors of the established Awaqf. Such Awqaf can be revitalized by linking them with the contemporary development needs of the countries. Large barren land holdings can be used for sustainable agro-forestry and agriculture given the food insecurity in most Muslim countries. For newly developed Awqaf, social development issues can be defined in flexible terms to accommodate the changing needs and requirements of the country and local population. To make this happen, there needs to be a clear roadmap and understanding of how Awqaf can potentially lead to sustainable development (Aamir Rehman, Afnan Koshak, and Habib Ahmed,

2021).

Bibliography

Aamir Rehman, Afnan Koshak, and Habib Ahmed (2021) The Role of Awqaf in

Achieving the SDGs and Vision 2030 in KSA | United Nations in Saudi Arabia.

Reserach Report. Saudi Arabia: United Nations/The Islamic Corporation for the

Development of the Private Sector, p. 104. Available at:

https://saudiarabia.un.org/en/146145-role-awqaf-achieving-sdgs-and-vision-2030-

ksa, https://saudiarabia.un.org/en/146145-role-awqaf-achieving-sdgs-and-vision2030-ksa (Accessed: 23 February 2023)

Abbasi, Z. (2019) ‘Waqf in Pakistan: Rebirth of a Traditional Institution’. Rochester,

NY. Available at: https://doi.org/10.2139/ssrn.3327092.

Abdullah, H. (2020) ‘THE CALIPH UTHMAN BIN AFFAN (R.A) AND THE

WELL.’, Awqaf SA, 17 August. Available at: http://awqafsa.org.za/the-caliphuthman-bin-affan-r-a-and-the-well/ (Accessed: 20 February 2023).

Abhishek Parmar (2017) Administration Of Waqf Board In India: Issues And

Challenges In Management. Available at:

https://www.legalserviceindia.com/legal/article-8640-administration-of-waqfboard-in-india-issues-and-challenges-in-management.html (Accessed: 24 February

2023).

Abubakar, M. (2019) ‘Waqf Philanthropy and Orphans’ Socio-Economic

Development in Northern Nigeria Based on Maqasid al Shariah Principles’, in K.M.

Ali, M.K. Hassan, and A. elrahman E.S. Ali (eds) Revitalization of Waqf for SocioEconomic Development, Volume I. Cham: Springer International Publishing, pp. 31–

- Available at: https://doi.org/10.1007/978-3-030-18445-2_3.

Ali, K.M. and Kassim, S. (2020) ‘Waqf Forest: How Waqf Can Play a Role In Forest

Preservation and SDGs Achievement?’, ETIKONOMI, 19(2), pp. 349–364.

Available at: https://doi.org/10.15408/etk.v19i2.16310.

Ali, K.M. and Kassim, S. (2021) ‘Development of Waqf Forest in Indonesia: The

SWOT-ANP Analysis of Bogor Waqf Forest Program by Bogor Waqf Forest

Foundation’, Jurnal Manajemen Hutan Tropika, 27(2), pp. 89–89. Available at:

https://doi.org/10.7226/jtfm.27.2.88.

Allah Pitchay, A. et al. (2018) ‘Cooperative-waqf model: a proposal to develop idle

waqf lands in Malaysia’, ISRA International Journal of Islamic Finance, 10(2), pp.

225–236. Available at: https://doi.org/10.1108/IJIF-07-2017-0012.

Almarri, J. and Meewella, J. (2015) ‘Social entrepreneurship and Islamic

philanthropy’, International Journal of Business and Globalisation, 15, pp. 405–

- Available at: https://doi.org/10.1504/IJBG.2015.071.

Australia’s Native Forests (2021) Bob Brown Foundation. Available at:

https://bobbrown.org.au/campaigns/native-forests/ (Accessed: 20 February 2023).

Avrami, E. et al. (2019) Values in Heritage Management: Emerging Approaches

and Research Directions. Getty Publications. Available at:

https://muse.jhu.edu/pub/331/oa_edited_volume/book/74916 (Accessed: 24

February 2023)

Azganin, H., Kassim, S. and Sa’ad, A.A. (2021) ‘Proposed waqf crowdfunding

models for small farmers and the required parameters for their application’, Islamic

Economic Studies, 29(1), pp. 2–17. Available at: https://doi.org/10.1108/IES-01-

2021-0006.

Baqutayan, S.M.S. et al. (2018) ‘Waqf Between the Past and Present’,

Mediterranean Journal of Social Sciences, 9(4), pp. 149–155. Available at:

https://doi.org/10.2478/mjss-2018-0124.

Catherine Bremer (2020) COVID-19 crisis threatens Sustainable Development

Goals financing - OECD. Available at: https://www.oecd.org/newsroom/covid-19-

crisis-threatens-sustainable-development-goals-financing.htm (Accessed: 24

February 2023).

Çelik, J. (2015) Waqf: The backbone of Ottoman beneficence, Daily Sabah.

Available at: https://www.dailysabah.com/feature/2015/06/09/waqf-the-backboneof-ottoman-beneficence (Accessed: 24 February 2023).

Celine Herweijer et al. (2020) How New Technologies Can Be Key to Tackling the

Global Goals. Available at: https://www.weforum.org/reports/unlockingtechnology-for-the-global-goals/ (Accessed: 23 February 2023).

Ceman Che Azizi, Asiah Kamal, and Muhammad Nazul Hoqu (2018) ‘The

Development of Principles in the Fiqh of Awqaf (The Principle of Perpetuity Versus

Temporality)’. Available at: https://islamicmarkets.com/publications/thedevelopment-of-principles-in-the-fiqh-of-awqaf-the (Accessed: 24 February 2023).

Cheikh Mbow et al. (2019) Chapter 5 : Food Security — Special Report on Climate

Change and Land. Reserach Report. Geneva, Switzerland: Intergovernmental Panel on Climate Change. Available at: https://www.ipcc.ch/srccl/chapter/chapter-5/

(Accessed: 24 February 2023).

Conte, G. (2022) ‘Defining financial reforms in the 19th-century capitalist worldeconomy: The Ottoman case (1838–1914)’, Capital & Class, 46(1), pp. 33–58.

Available at: https://doi.org/10.1177/03098168211022222.

Fay, M.A. (1997a) ‘Women and Waqf: Toward a Reconsideration of Women’s Place

in the Mamluk Household’, International Journal of Middle East Studies, 29(1), pp.

33–51.

Fay, M.A. (1997b) ‘Women and Waqf: Toward a Reconsideration of Women’s

Place in the Mamluk Household’, International Journal of Middle East Studies,

29(1), pp. 33–51. Available at: https://doi.org/10.1017/S002074380006414X.

Hussain, M. et al. (2016) Agriculture and Food Security in OIC Member Countries.

Available at: https://doi.org/10.13140/RG.2.2.36425.95840.

Ibrahim, S.S. et al. (2022) ‘Waqf integrated income generating model (WIIGM) for

enhancing sustainable development goals (SDGS) in Malaysia: an evaluation of

behavioural intention’, International Journal of Ethics and Systems, ahead-ofprint(ahead-of-print). Available at: https://doi.org/10.1108/IJOES-02-2022-0030.

Irfan Syauqi Beik et al. (2022) GREEN WAQF FRAMEWORK | United Nations

Development Programme. Reserach Report. Indonesia, p. 72. Available at:

https://www.undp.org/indonesia/publications/green-waqf-framework (Accessed: 23

February 2023).

Jennifer Celik (2015) Significance of Philanthropic Institutions in Ottoman Social

Life - The Fountain Magazine, Daily Sabah. Available at:

https://fountainmagazine.com/2012/issue-88-july-august-2012/significance-ofphilanthropic-institutions-in-ottoman-social-life (Accessed: 24 February 2023).

Josh and Mak (2014) ‘Legal principles of Waqf in Pakistan (Legal Advice Series

10) – Josh and Mak International’, Legal Principle of Waqf in Pakistan (Legal advice

series 10), 3 November. Available at: https://joshandmakinternational.com/legalprinciples-of-waqf-in-pakistan-legal-advice-series-10/ (Accessed: 20 February

2023).

Khalifah Muhamad Ali et al. (2021) ‘The Role of Waqf Forests in the Prevention of

Natural Disasters in Indonesia – BWPS No. 2, 2021 | Badan Wakaf Indonesia |

BWI.go.id’, Badan Wakaf Indonesia (BWI) [Preprint]. Available at:

https://www.bwi.go.id/6813/2021/04/30/the-role-of-waqf-forests-in-theprevention-of-natural-disasters-in-indonesia-bwps-no-2-2021/ (Accessed: 24

February 2023).

Reforest’ Action (2020) Reforest’Action. Available at:

https://www.reforestaction.com/en (Accessed: 20 February 2023).

Rutt, R. (2009) ‘Creating forestry jobs to boost the economy and build a green

future’, 60.

SDG Knowledge Hub (2022) CEOs Explore Solutions to Bridge Annual USD 4.3

Trillion SDG Financing Gap | News | SDG Knowledge Hub | IISD. Available at:

https://sdg.iisd.org/news/ceos-explore-solutions-to-bridge-annual-usd-4-3-trillionsdg-financing-gap/ (Accessed: 24 February 2023).

Shafinar Ismail, M. Hassan, and Suharni Rahmat (2023) Islamic Social Finance –

Waqf, Endowment, and SMEs | Elgar Online: The online content platform for

Edward Elgar Publishing. Available at:

https://www.elgaronline.com/monobook/book/9781803929804/9781803929804.x

ml (Accessed: 21 February 2023).

Shukri, N., Zamri, S. and Muneeza, A. (2019) ‘Waqf Development in Marawi City

via Issuance of Perpetual Waqf Sukuk’, International Journal of Management and

Applied Research, 6, pp. 68–80. Available at: https://doi.org/10.18646/2056.62.19-

005.

The Awqaf Properties Investment Fund (2021) Annual Report 2021, The Awqaf

Properties Investment Fund. Available at: https://www.isdb.org/apif/publications

(Accessed: 24 February 2023).

Tribune (2022) ‘Nigeria, OIC initiate policy to achieve food security in member

countries’, Nigeria, OIC initiate policy to achieve food security in member countries,

22 December. Available at: https://tribuneonlineng.com/nigeria-oic-initiate-policyto-achieve-food-security-in-member-countries/ (Accessed: 24 February 2023).

Vaghefi, N., Siwar, C. and Aziz, S.A.A.G. (2015) ‘Green Economy: Issues,

Approach and Challenges in Muslim Countries’, Theoretical Economics Letters,

05(01), p. 28. Available at: https://doi.org/10.4236/tel.2015.51006.

World Bank (2013) Crowdfunding’s Potential for the Developing World.

Washington, DC: World Bank. Available at:

https://openknowledge.worldbank.org/handle/10986/17626 (Accessed: 20 February

2023)

Khalil, I., Ali, M.Y. and Shaiban, M. (2019) ‘Waqf Fund Management In Kuwait

And Egypt: Can Malaysia Learns From Their Experiences’, in.

Michele Scataglini, Marc and J. Ventresca (2019) Funding the UN Sustainable

Development Goals: Lessons from Donation-Based Crowdfunding Platforms.

Available at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3328731

(Accessed: 24 February 2023).

Omercic, J. (2017) ‘Waqf in Bosnia and Herzegovina in the 20th and 21st Century’,

Islam and Civilisational Renewal, 8, pp. 342–367. Available at:

https://doi.org/10.12816/0042924.

Orbay, K. (2017) ‘Imperial Waqfs within the Ottoman Waqf System’, Endowment

Studies, 1(2), pp. 135–153. Available at: https://doi.org/10.1163/24685968-

00102002.

‘Our Model’ (2020) myWakaf. Available at: https://www.mywakaf.com.my/ourmodel/ (Accessed: 23 February 2023).

Pakistan’s Ten Billion Tree Tsunami (2021) UNEP. Available at:

http://www.unep.org/news-and-stories/story/pakistans-ten-billion-tree-tsunami

(Accessed: 25 October 2021).

Pianciola, N. and Sartori, P. (2007) ‘Waqf in Turkestan: the colonial legacy and the

fate of an Islamic institution in early Soviet Central Asia, 1917–1924’, Central Asian

Survey, 26(4), pp. 475–498. Available at:

https://doi.org/10.1080/02634930802017929.

Pirbabaei, M.T. (2008) ‘Phenomenology of Waqf in material forming of islamic

cities’, in. 16th ICOMOS General Assembly and International Symposium: ‘Finding

the spirit of place – between the tangible and the intangible’, Quebec, Canada, pp.

1–8. Available at:

http://www.international.icomos.org/quebec2008/cd/toindex/77_pdf/77-wX9i292.pdf (Accessed: 20 February 2023).

Rashied Omer (2011) Al-Azhar: beyond the Politics of State Patronage | Contending

Modernities. Available at: https://contendingmodernities.nd.edu/global-currents/alazhar-beyond-the-politics-of-state-patronage/ (Accessed: 24 February 2023).

Zuki, M.S.Md. (2012) ‘Waqf and its Role In Socio-Economic Development’, in

ISRA International Journal of Islamic Finance, pp. 173–178. Available at:

https://doi.org/10.12816/0002755.